We've just launched a new set of Mutual Funds APIs that change the game for mutual funds trading. We're making available end-of-date quote data, as well as years of performance, risk, holdings, purchase info, sustainability, and profile summary for 200,000+ international funds from 50+ countries.

Reference data

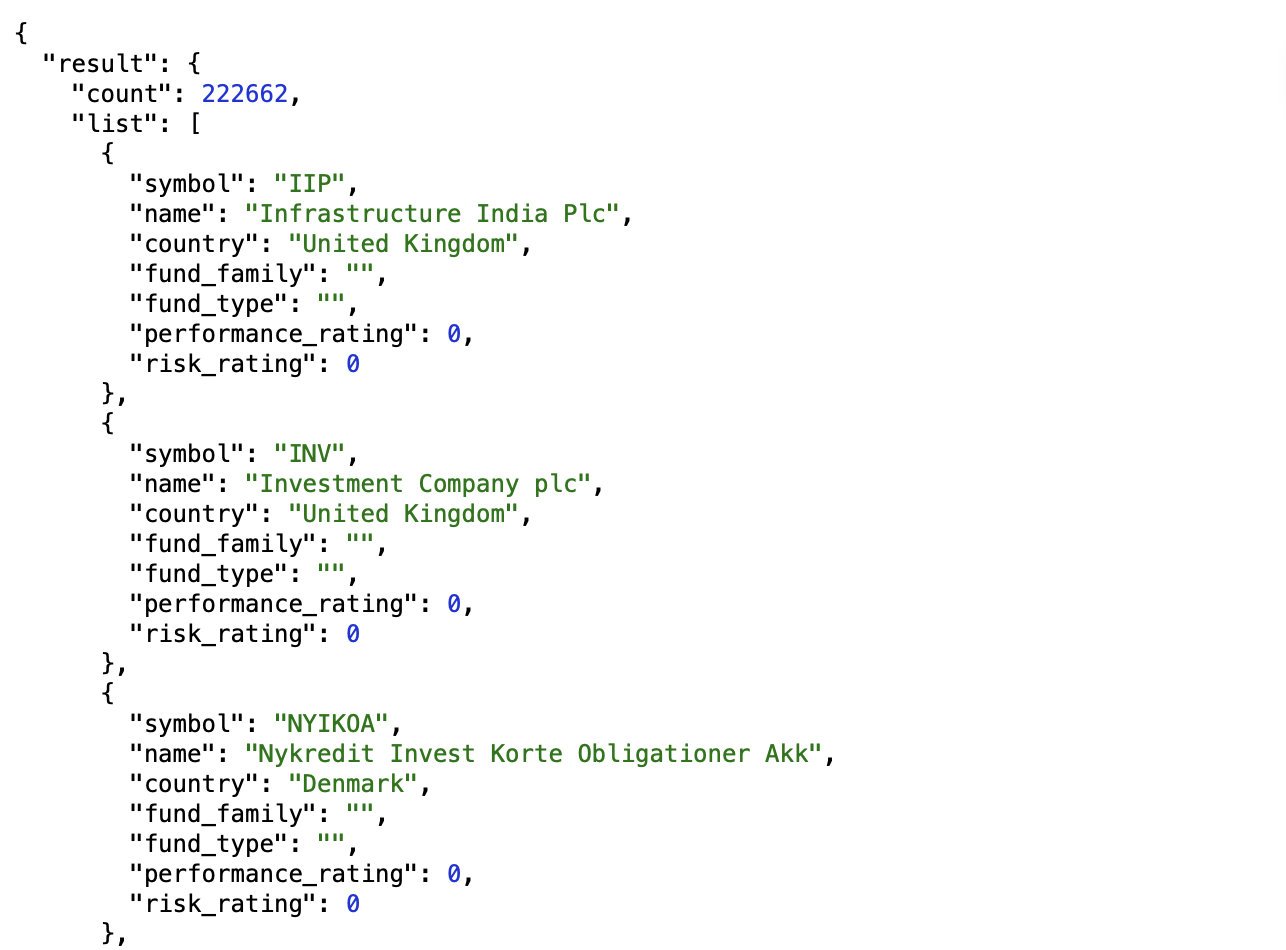

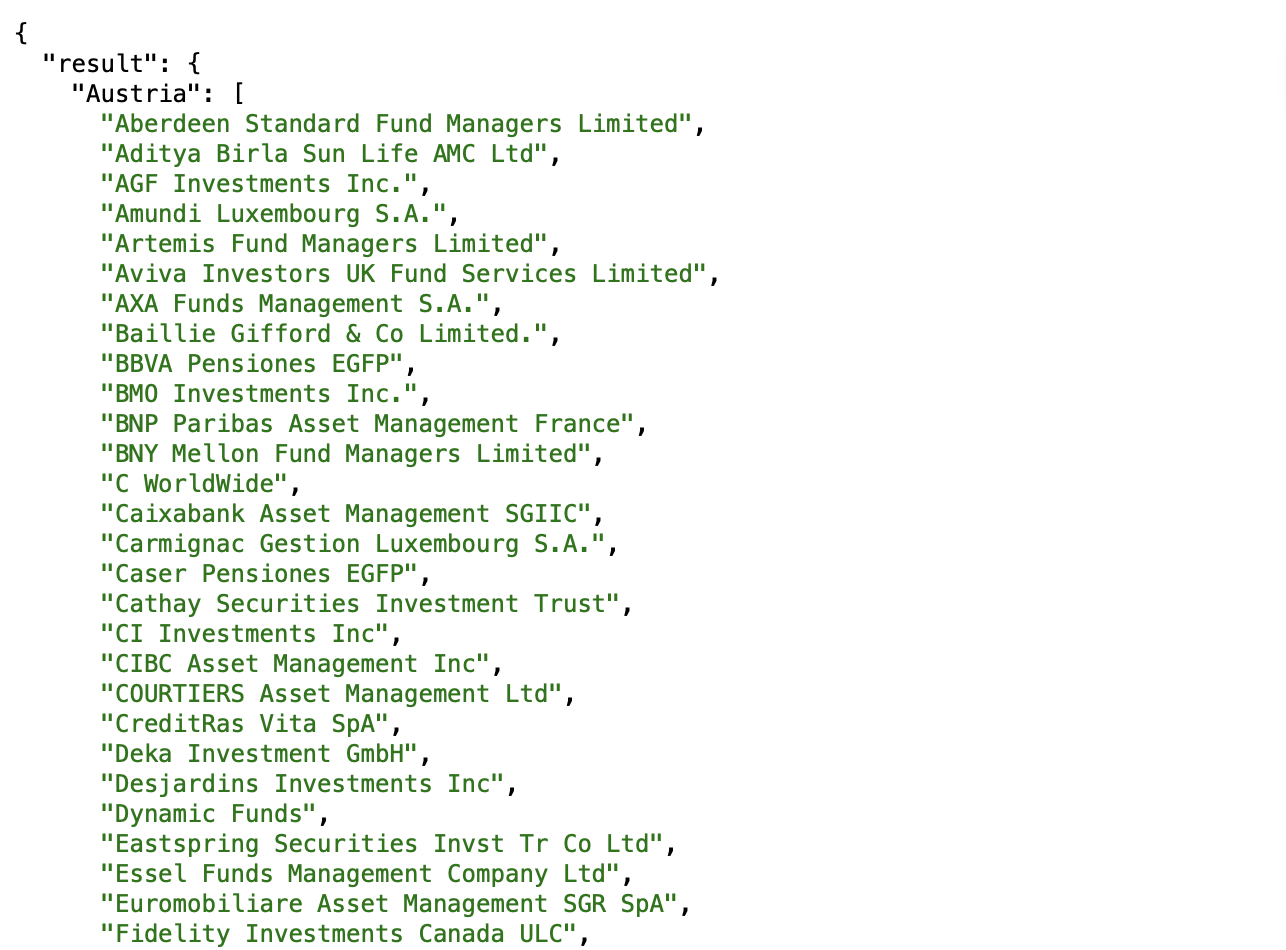

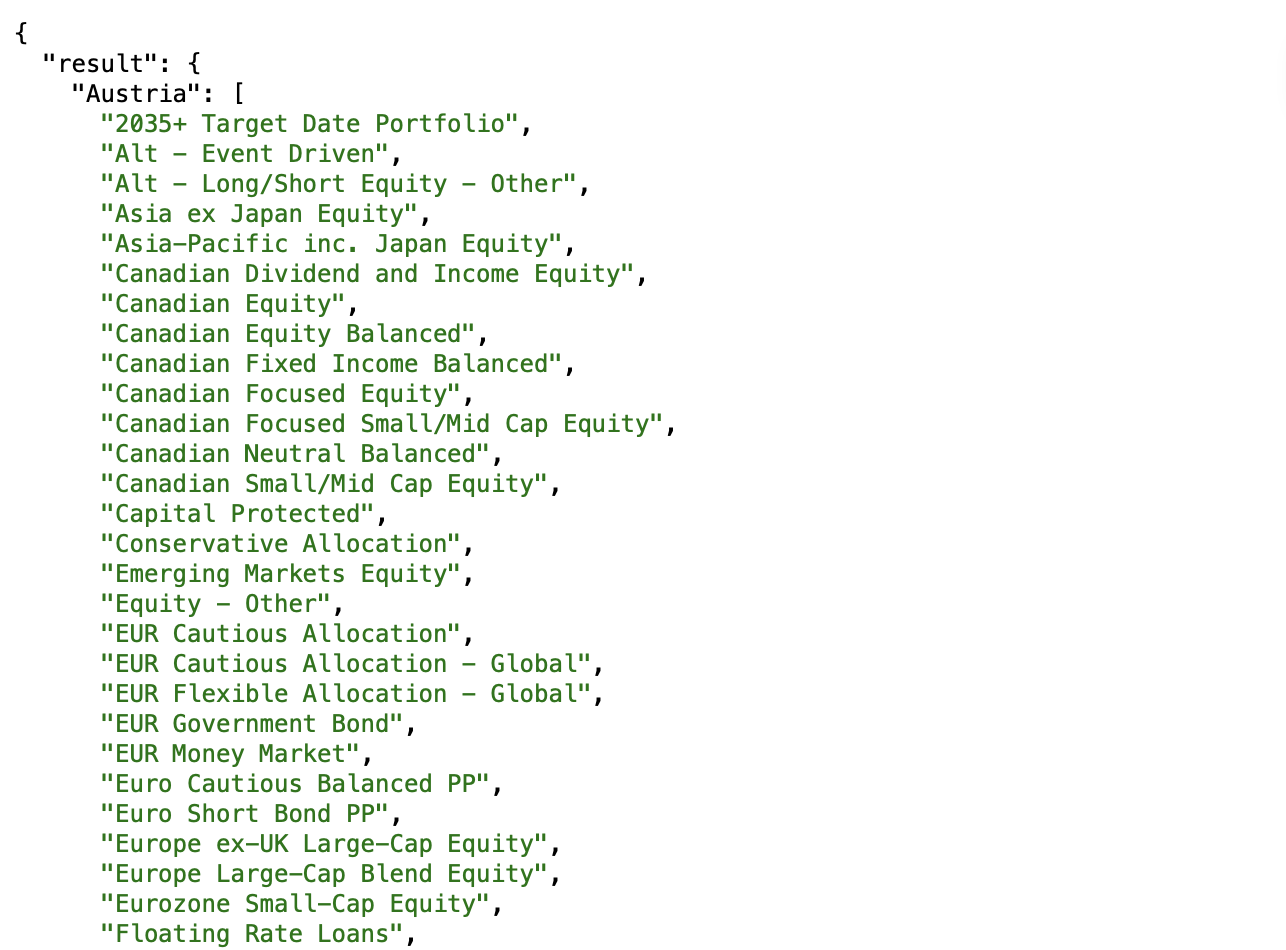

We've designed our new APIs to make it as easy as possible to search, filter, and sort mutual funds so that you can slice the market any way you need to. Using our new /mutual_funds endpoint, you can search for any fund, family, or type.

For instance, to get the list of 50 most significant mutual funds, make the following query:

https://api.twelvedata.com/mutual_funds/list

As always, you can filter by many parameters, including country, family, type, etc.

Prices

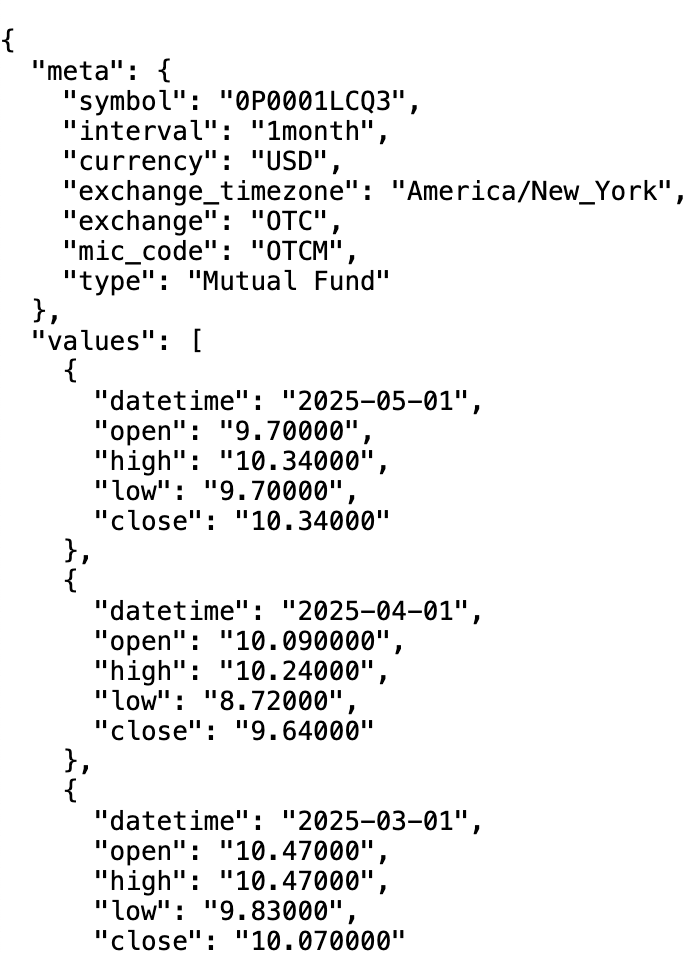

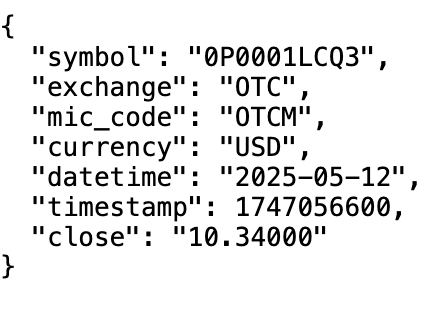

Mutual Funds prices are updated once a day after the market is closed. Standard price endpoints are available for that, such as /time_series, /quote, and /eod endpoints.

Mutual Fund breakdown

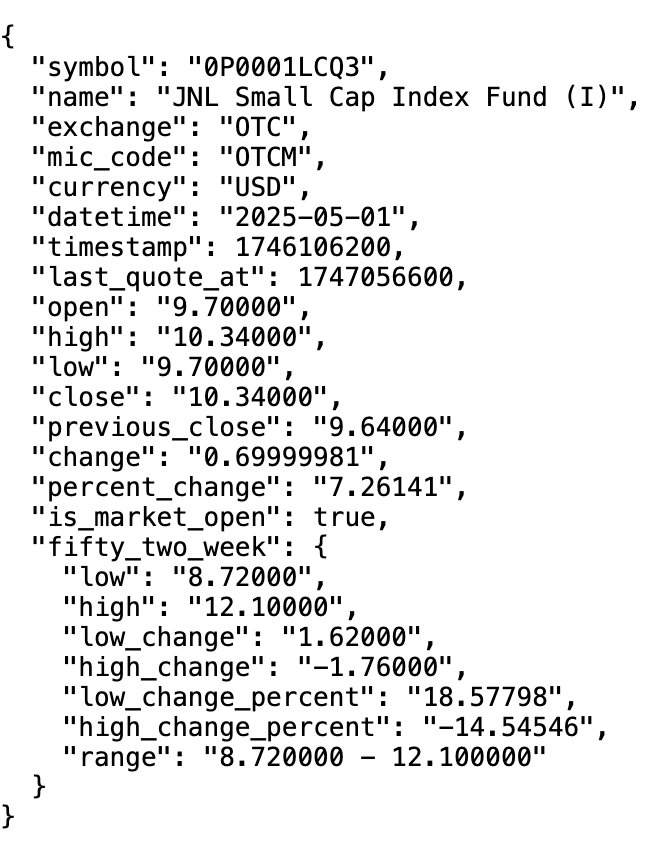

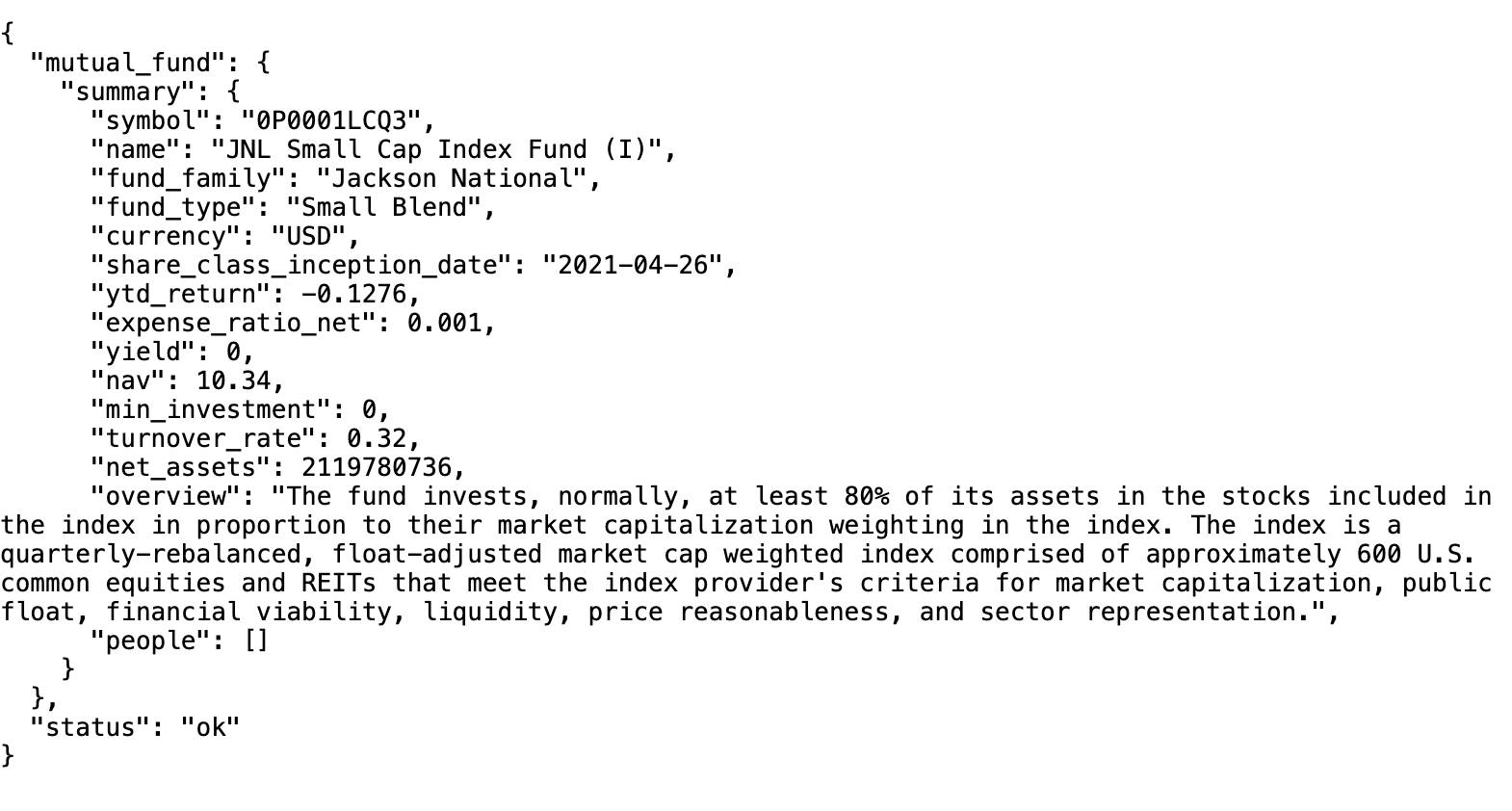

For example, to find out the primary information of JNL Small Cap Index Fund (I), we can query

https://api.twelvedata.com/mutual_funds/world/summary?symbol=0P0001LCQ3&apikey=demo

This gives us a detailed profile of the fund.

Once you’ve got a summary, you should be able to query all other fund’s metrics individually or altogether.

Performance

https://api.twelvedata.com/mutual_funds/world/performance?symbol=0P0001LCQ3&apikey=demo

Risk

https://api.twelvedata.com/mutual_funds/world/risk?symbol=0P0001LCQ3&apikey=demo

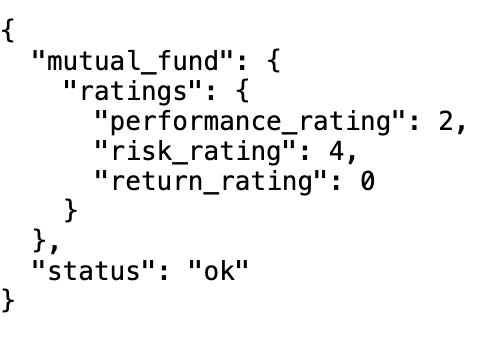

Ratings

https://api.twelvedata.com/mutual_funds/world/ratings?symbol=0P0001LCQ3&apikey=demo

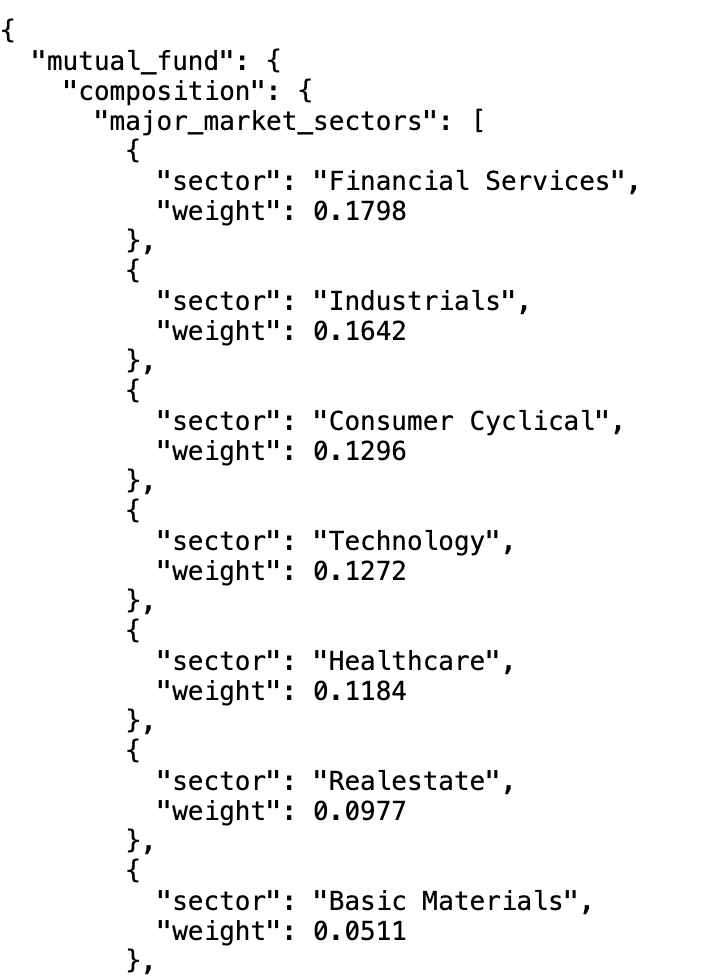

Holdings

https://api.twelvedata.com/mutual_funds/world/composition?symbol=0P0001LCQ3&apikey=demo

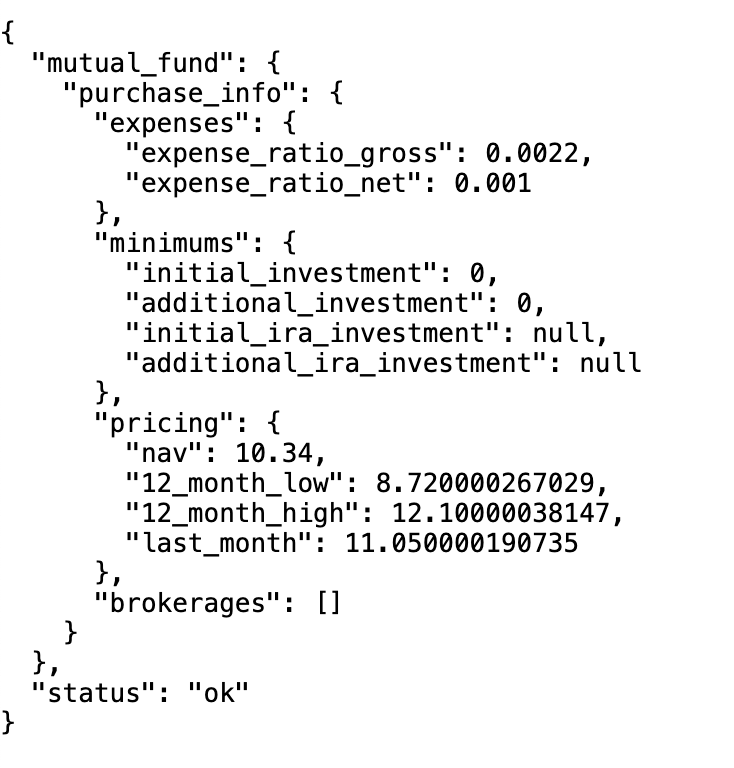

Purchase information

https://api.twelvedata.com/mutual_funds/world/purchase_info?symbol=0P0001LCQ3&apikey=demo&source=docs

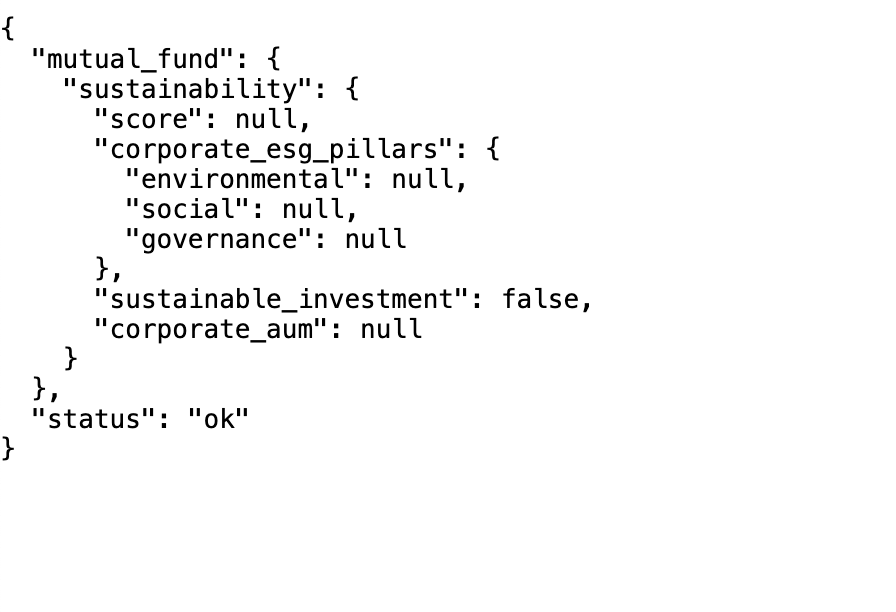

Sustainability

https://api.twelvedata.com/mutual_funds/world/sustainability?symbol=0P0001LCQ3&apikey=demo&source=docs

All data

https://api.twelvedata.com/mutual_funds/world?symbol=0P0001LCQ3&apikey=demo

Advantages of Mutual Funds APIs

Mutual Funds API database streamlines the process of accessing mutual fund data for investors, traders, and other use cases. Our comprehensive and diverse database has various bespoke advantages.

-

Comprehensive data access: Our Mutual Funds APIs provide a treasure trove of valuable data on over 200,000 international funds from more than 50 countries. Access essential information such as end-of-date quote data, years of performance, risk metrics, holdings, purchase details, sustainability insights, and profile summaries.

-

Simplified market analysis: With our user-friendly design, exploring the mutual funds market becomes effortless. Easily search, filter, and sort funds according to your specific requirements. Whether you need to analyze a particular fund, family, or fund type, our /mutual_funds endpoint allows you to slice and dice the market with ease.

-

Real-time pricing: Stay up-to-date with the latest mutual fund prices, updated once a day after the market closes. Our standard price endpoints, including /time_series, /quote, and /eod, keep you informed about the most recent pricing information.

-

Detailed fund breakdown: Want in-depth information about a specific mutual fund? Our APIs make it simple to access primary data on funds like the Vanguard 500 Index Fund Admiral Shares. By querying the appropriate endpoint, such as /mutual_funds/world/summary?symbol=0P0001LCQ3&apikey=demo, you can receive a comprehensive profile of the fund.

-

Customizable analysis: Tailor your investment strategies by accessing individual fund metrics or retrieving all relevant data in one go. Our Mutual Fund APIs empower you to make informed decisions and optimize your investment approach.

Potential Uses of Mutual Funds API Data

Investing in mutual funds is a wise decision as it offers a more diversified portfolio compared to investing separately in stocks of only a few companies.

Some potential uses of mutual funds data include:

- Investment research and analysis

- Portfolio construction and diversification

- Performance tracking

- Risk assessment and management

- Financial planning and goal-based investing

- Regulatory compliance and reporting

- Educational resources and content creation

- Market trends and insights

- Investment product development

- Asset allocation strategies

- Benchmarking and performance evaluation

We’ve spent the last few months tuning performance, and we’re excited to make this fully available to everyone starting today. Check out the docs, and leave us feedback.

Updated May 13, 2025